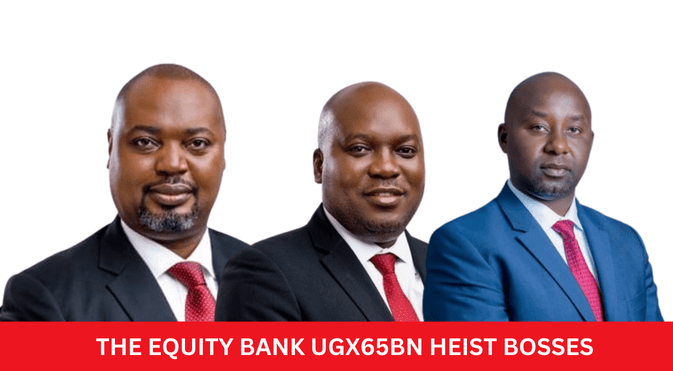

A stunning twist has emerged in the ongoing investigation into Equity Bank’s UGX65 billion fraud scandal, as the Director of Public Prosecutions (DPP) has ordered the release of Kenneth Onyango, the bank’s former Executive Director in Charge of Commercial Banking. The DPP’s decision, revealed by The Investigator, was made not due to lack of evidence against Onyango but to facilitate a broader investigation into the intricate web of high-profile individuals implicated in the scandal.

The scandal, which dates back to 2018, involves fraudulent loans and financial misconduct by top-ranking officials, including former Managing Director Samuel Kirubi, his confidant Kezia Dorothy Asiimwe (Head of Finance), and current MD Anthony Kituuka. A leaked dossier, verified by The Investigator, exposes a grim picture of systemic corruption, including a UGX29.3 billion loan obtained by Kirumbi through Luwaluwa Investment Ltd under false pretenses.

The investigation has revealed a complex network of corruption, involving debt collection company JALD, owned by Ronald Luwangula, with close ties to Kirubi and other Equity Bank executives. JALD was allegedly involved in concealing fraudulent activities and received preferential treatment, with its invoices fast-tracked and approved without scrutiny.

The scandal has taken on an international dimension, with Kenyan executives involved in Equity Bank’s Ugandan operations. Kenyan-led investigations have ensured that Kenyan nationals, such as former Head of Credit Jimmy Mwangangi, were quietly sent back home to avoid prosecution, while Ugandan staff remain imprisoned on suspected trumped-up charges.

The DPP’s call for a broader investigation has raised hopes that justice will be served, but the public remains skeptical, wondering if powerful individuals will escape unscathed. The stakes are high, with millions of shillings at stake and the integrity of one of Uganda’s largest financial institutions hanging in the balance. As the investigation unfolds, one thing is clear – the UGX65 billion scandal is far from over, and the truth may be more shocking than anyone ever imagined.

2 comments

Scovia I have a sad story to share with you regarding equity bank, kindly get back to me and I share with you this story

Kindly use my email