In 2019, two employees at Airtel Uganda discovered something that didn’t sit right.

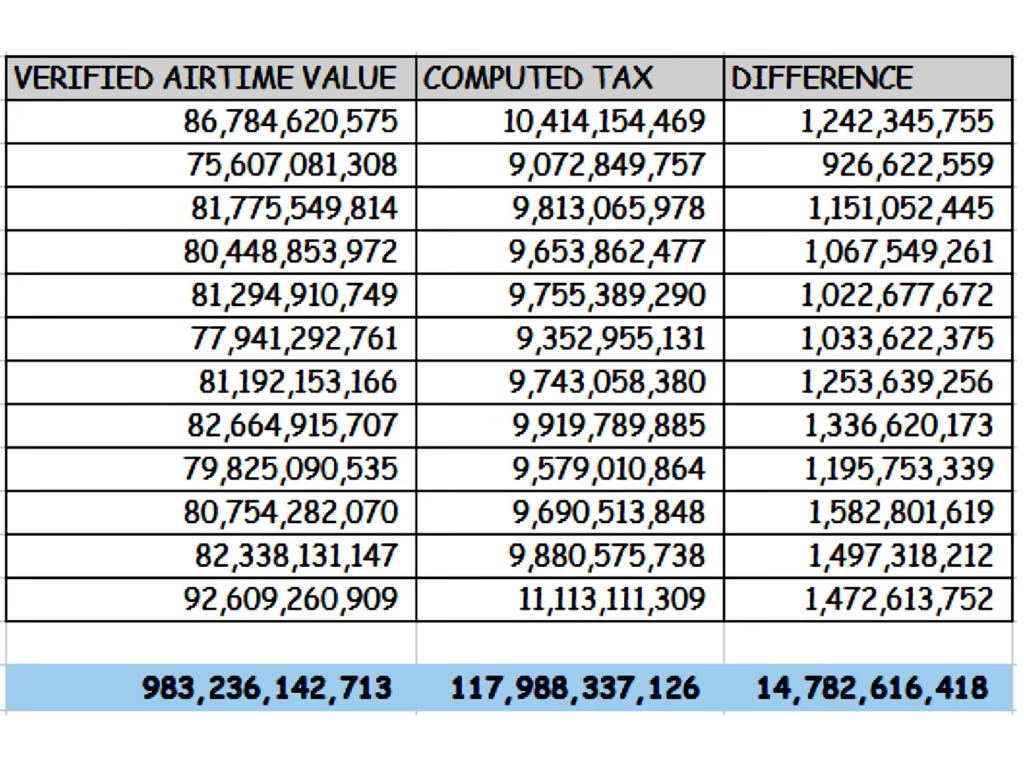

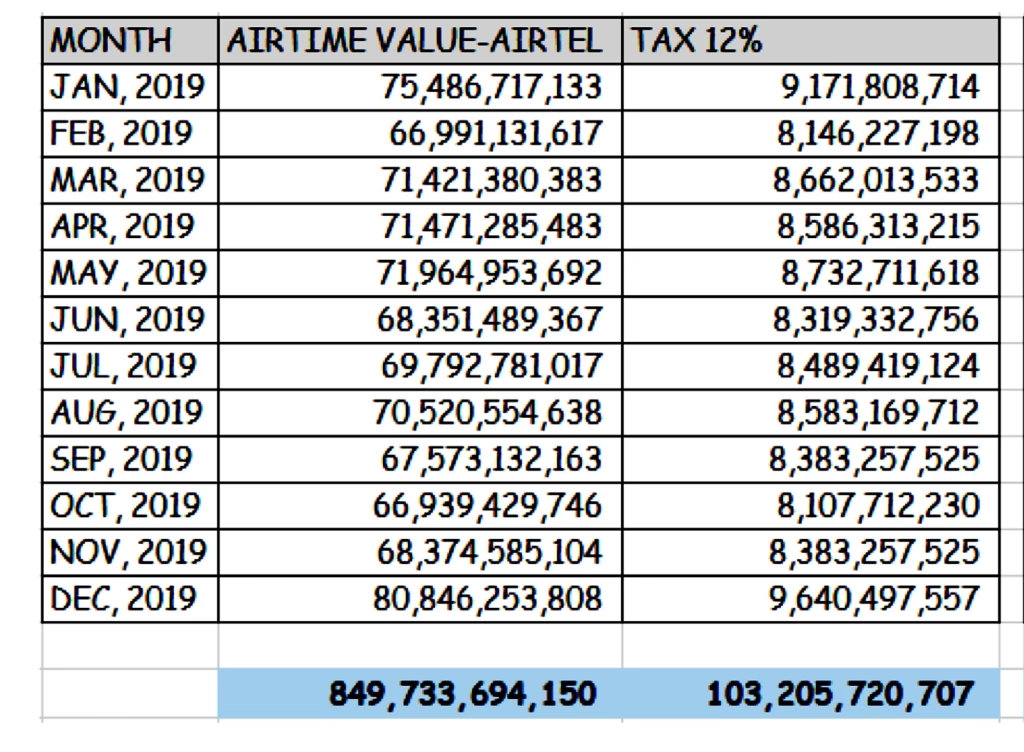

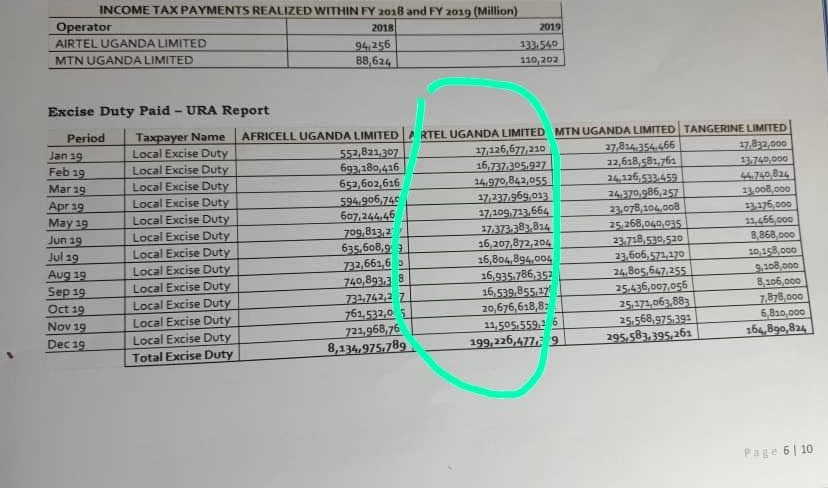

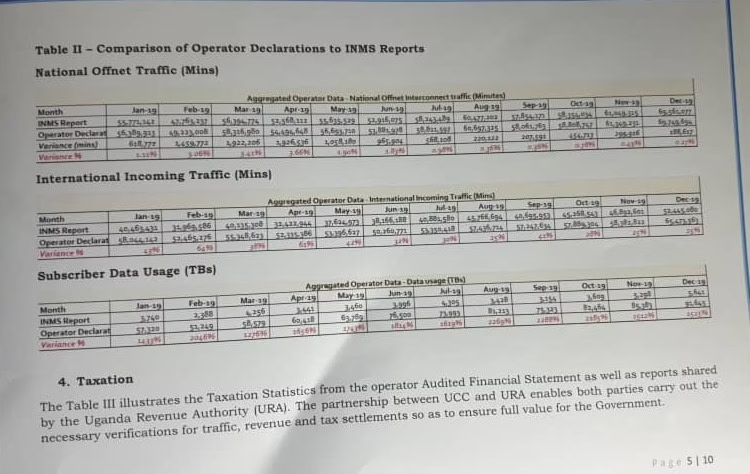

While working on internal records, they noticed discrepancies between the amount of airtime sold and the tax reported to the government. What they found suggested that Airtel, one of Uganda’s largest telecom companies, may have failed to fully declare the 12% excise duty on airtime — a tax that all telecoms are legally required to collect and submit.

The amount in question? Nearly UGX 14 billion.

Alarmed, the two whistleblowers compiled a detailed report. They took it directly to John Musinguzi, Commissioner General of the Uganda Revenue Authority (URA), and Peter Ogwang, who was then serving as State Minister for ICT.

They expected action. Instead, they were met with silence

According to Uganda’s Excise Duty Act of 2018, a 12% tax must be applied to all airtime — whether it’s bought through scratch cards, Airtel Money, corporate bundles, or credit systems.

But the whistleblowers noticed that Airtel Uganda was reporting lower-than-expected tax on several types of airtime transactions, including:

Airtime purchased through Airtel Money

Airtime directly credited to VIP and corporate clients

Airtime accessed through loan or credit services

Electronic airtime systems that bypassed mobile money

In many of these cases, customers paid the tax — but it appears the full amount never made it to the Uganda Revenue Authority.

When the whistleblowers submitted their findings to Musinguzi and Ogwang, they expected an audit, maybe even a public investigation.

Instead, the issue was quietly pushed aside.

“There was no response. No follow-up. It was as if the report was never submitted,” said one of the whistleblowers, who spoke on condition of anonymity.

And just like that, the issue was buried. Airtel continued its operations. The officials carried on. And the public never heard a word — until now.

When companies don’t pay their fair share of taxes, someone else has to — and it’s usually the public.

Over the past few years, Ugandans have felt increasing financial pressure. Fuel prices have risen. Small businesses are being taxed more heavily. Everyday items are becoming harder to afford. The revenue lost from tax evasion doesn’t just vanish — it’s made up through higher taxes on ordinary people or cuts to public services.

And this is money the public already paid. Every time you buy airtime in Uganda, you pay the 12% excise duty. But when telecoms fail to pass that money on, you end up paying twice — first in airtime tax, then in lost services and higher costs elsewhere.

“It’s painful,” said Miriam, a mobile money agent in Wakiso. “We pay the tax, but where does it go? If big companies are allowed to cheat, it’s us who suffer.

This isn’t just about Airtel Uganda. It’s about trust — in companies, in government, and in the systems meant to protect the public.

The whistleblowers did the right thing. They found a serious issue, collected evidence, and reported it through the proper channels. But their report was ignored by the very leaders tasked with holding powerful entities accountable.

John Musinguzi and Peter Ogwang had a chance to act. Instead, their inaction allowed billions in public money to be lost — and contributed to the rising financial pressure facing millions of Ugandans

Experts are now calling for urgent reforms:

Greater transparency in how telecom companies report and pay airtime taxes

Independent audits into the telecom sector’s tax compliance

Clear definitions of taxable airtime, especially in digital systems

Legal protection for whistleblowers, so more people feel safe speaking up

“We can’t keep letting this happen,” said James, a civil society advocate. “If government institutions ignore fraud, then who protects the taxpayer?”

Airtel Uganda may have failed to pay UGX 14 billion in airtime taxes. The Uganda Revenue Authority and the ICT Ministry were reportedly informed — and chose not to act.

The result? Billions in lost public funds. More pressure on ordinary citizens. And a growing sense that some are above the law, while the rest of the country pays the price.

For real accountability, this issue can’t be ignored any longer. Uganda deserves answers — and action.