This week, Parliament passed the Excise duty amendment Bill 2024 with a tax increase on fuel (Kerosene Inclusive), lime, adhesive & grout and on mineral water.

Earlier on, the proposers of this bill had suggested a levy increase of UGX 300 on kerosene, which was rejected by some members of Parliament and it was reduced up to 50 shillings.

This clearly shows how some of the leaders we send to Parliament to represent us, are totaly out of touch on the real issues affecting the people they profess to be representing and leading.

Just here in Wakiso a few kilometers from the main road, you can walk for an hour without seeing an electric pole anywhere, yet they are Ugandans like us and their only option to have some light during the night is either by solar energy or by lamps which use kerosene.

We all know that majority of Ugandans in villages use kerosene and it is already expensive to some, then how can a right thinking Ugandan wake up with a stupid idea of getting more from those who are already poor, yet the rich are busy getting tax holidays and some in government don’t even pay their tax share?

On Petrol and Diesel, there is now a levy increase of UGX 100 on every liter you will be purchasing, meaning the people who are getting commodities from upcountry and those in the transportation business are also going to increase their prices and fare charges.

We should all be asking ourselves whether Fuel and Kerosene are the only things government can get revenue increase from or it is just an intentional move to make the law income earners more poorer?

Uganda is currently grappling with unemployment and a few of the young people who are lucky, they are doing casual jobs in local water factories that are starting up now and then.

When you increase taxes levied on mineral water, the production quantities in these factories is likely to drop, which will bring up the need to reduce on the human resource since many people will resort to home made water.

There is no country that has ever developed in modern history, with a revenue plan that targets it’s low income earners citizenship. The new levies on fuel, kerosene and water lack the principle of neutrality in them and i am very certain that the drafters of this bill, had no good financial intentions for the low income earners and for Uganda as a country.

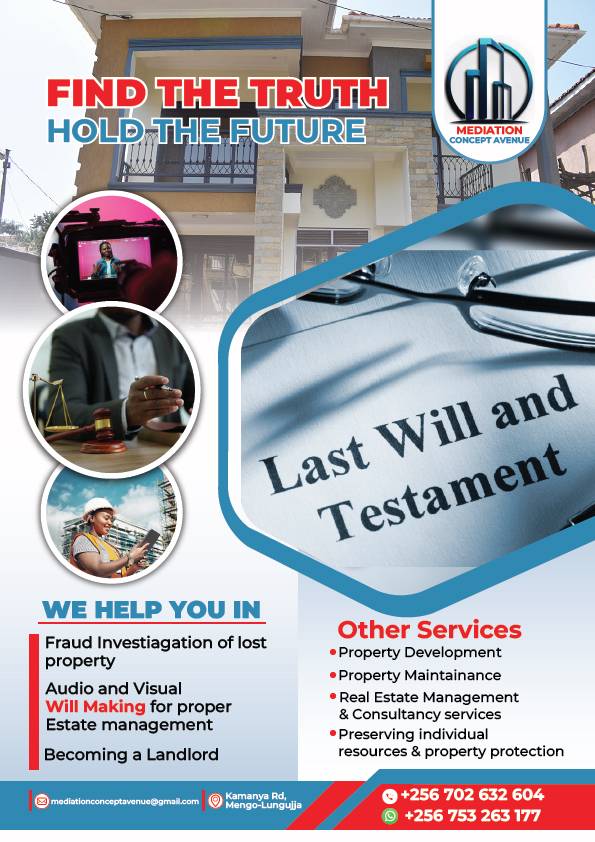

Advertisement.